India’s Inflation Rate: The Ministry of Commerce and Industry released recent inflation figures for August 2025, showing that the annual rate of inflation based on the All India Wholesale Price Index (WPI) edged up to 0.52 percent. This comes after two consecutive months of negative inflation, marking a notable trend reversal in India’s price dynamics. At the same time, Consumer Price Index (CPI) inflation, used to track retail price movements, saw a slight increase to 2.07 percent in August, though food prices continued to decline, easing the pressure on household budgets. Let’s break down the data and what it means for India’s economy.

Table of Contents

WPI Inflation: What Changed in August 2025?

The Wholesale Price Index (WPI) is widely used to gauge inflation at the wholesale level in India. In August 2025, WPI inflation turned positive, climbing to 0.52 percent year-on-year compared to -0.58 percent in July—the sharpest drop of the year. The uptick was primarily driven by higher prices for food products and manufactured goods, as well as non-food articles, other non-metallic mineral products, and transport equipment.

- Food prices under the WPI rose 0.21 percent, reversing the previous month’s steep decline of -2.15 percent. Key drivers included wheat (up 4.75%), milk (up 2.58%), and cereals (up 1.03%).

- Manufactured products saw 2.55 percent inflation, a faster pace than July’s 2.05 percent.

- Non-food articles, mineral products, and transport equipment contributed to the rise, underscoring renewed activity in various industry segments.

On the flip side, prices for petroleum, diesel, and natural gas continued their downward trend, pushing fuel inflation further into the negative, at -3.17 percent in August. This extended the decline from July, when fuel inflation was at -2.43 percent. This negative fuel inflation helped offset some upward pressure from other sectors.

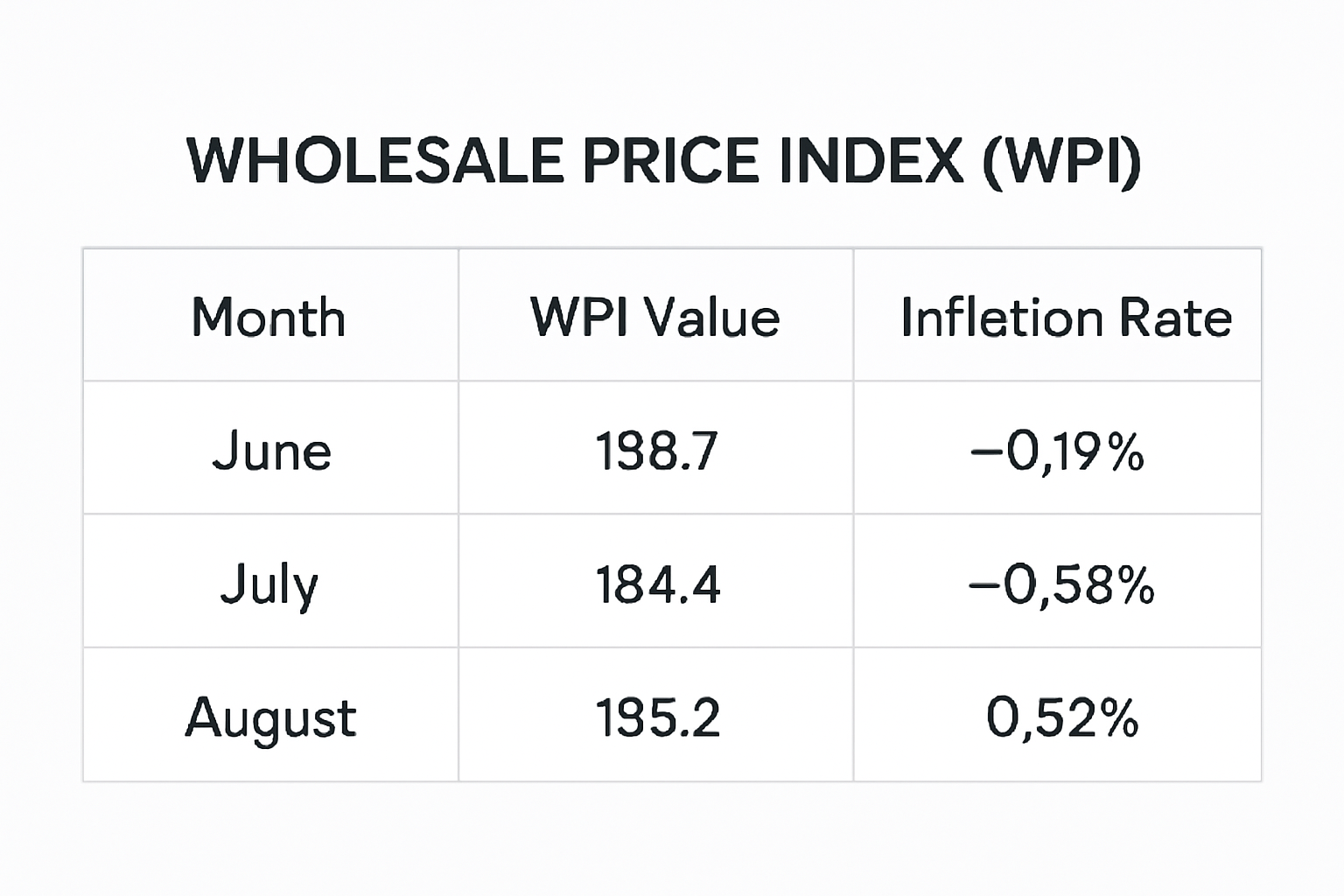

Month-Over-Month WPI Movement

The data shows a month-over-month WPI increase for August of 0.52 percent, a clear rebound from the previous month’s record low. June’s WPI had stood at 153.7 points (-0.19% inflation), July at 154.4 points (-0.58%), and August at 155.2 points (0.52%).

CPI Inflation: Retail Price Trends in August 2025

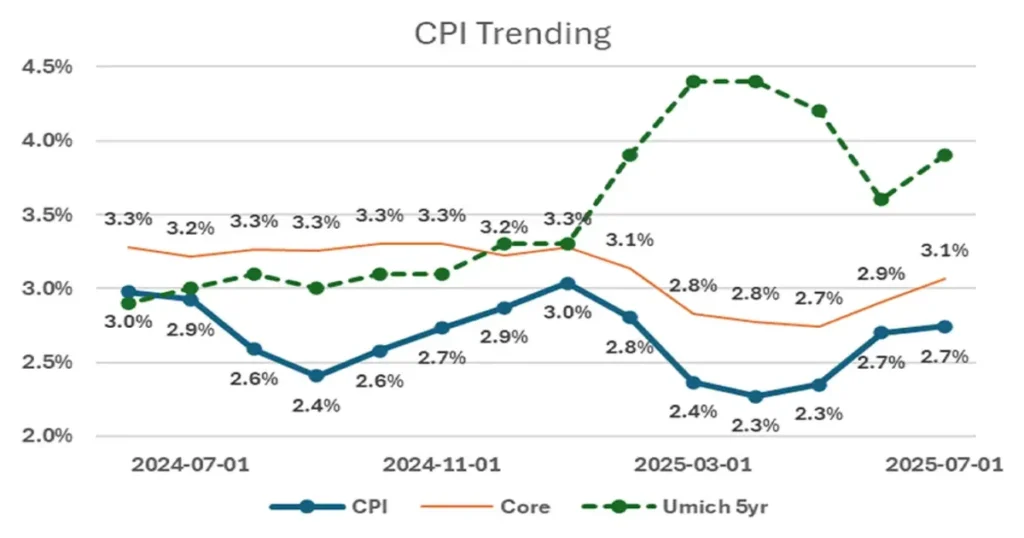

While wholesale inflation picked up, retail inflation based on the Consumer Price Index (CPI) nudged up to 2.07 percent in August, compared to 1.61 percent in July—still well within the RBI’s 4 percent target range. This moderate rise in CPI inflation is mostly attributed to changing food prices.

- Food inflation measured by CPI was estimated at -0.69 percent in August, continuing a three-month streak in the negative zone. This was largely because of falling vegetable prices (down 15.92%) and cheaper pulses (down 14.53%)—providing relief for consumers.

- Prices for spices declined by 3.24 percent as well.

- However, headline and food inflation in August were slightly higher than July, mainly due to increases in meat and fish, edible oils and fats, eggs, and the cost of personal care items.

Despite these variations, the overall inflation rate remains comfortable for both households and policymakers.

RBI’s Inflation Outlook and Monetary Policy

With inflation still below the RBI’s 4 percent threshold, the central bank is expected to maintain its “soft money” policy stance, prioritizing growth and liquidity in the market. RBI Governor Sanjay Malhotra stated, “The inflation outlook for 2025-26 has become more benign than expected in June. Large favourable base effects combined with steady progress of the southwest monsoon, healthy kharif sowing, adequate reservoir levels and comfortable buffer stocks of foodgrains have contributed to this moderation.”

The RBI has forecast CPI inflation to be 3.1 percent for 2025-26, highlighting optimism thanks to a robust monsoon and strong kharif crop sowing.

What Does This Mean for Indian Consumers and Businesses?

- Food Prices: Continued declines in vegetables, pulses, and spices are providing relief to consumers. However, the recent bounce in certain segments like meat and edible oils suggests caution for future months.

- Fuel Prices: The ongoing reduction in fuel costs is good news for transport and logistics sectors, though other manufacturing costs are rising.

- Business Impact: Industries linked to food and manufacturing may see cost adjustments, but continued low inflation overall means businesses can plan with more certainty.

Conclusion: Stable Inflation, Cautious Optimism

August 2025 marked a pivotal month for India’s inflation metrics, with WPI turning positive and CPI remaining subdued. The stabilization of food prices and the reduction in fuel costs are key contributors, allowing the RBI to persist with supportive monetary policy. Both businesses and consumers can expect a stable pricing environment moving forward, as long as weather and global supply trends remain supportive.

India’s inflation numbers are watched closely as economic recovery gains traction in 2025, and policymakers will continue to steer a careful course.